19.07.2024

Understanding 1099 vs. W-2 Employees: What’s the Difference?

Specialty HR Consulting

HR Consultant

At Specialty HR Consulting, we’re here to help you navigate the complexities of hiring and managing your workforce. One key distinction every employer should understand is the difference between 1099 and W-2 employees. Here’s a quick guide to help you make informed decisions:

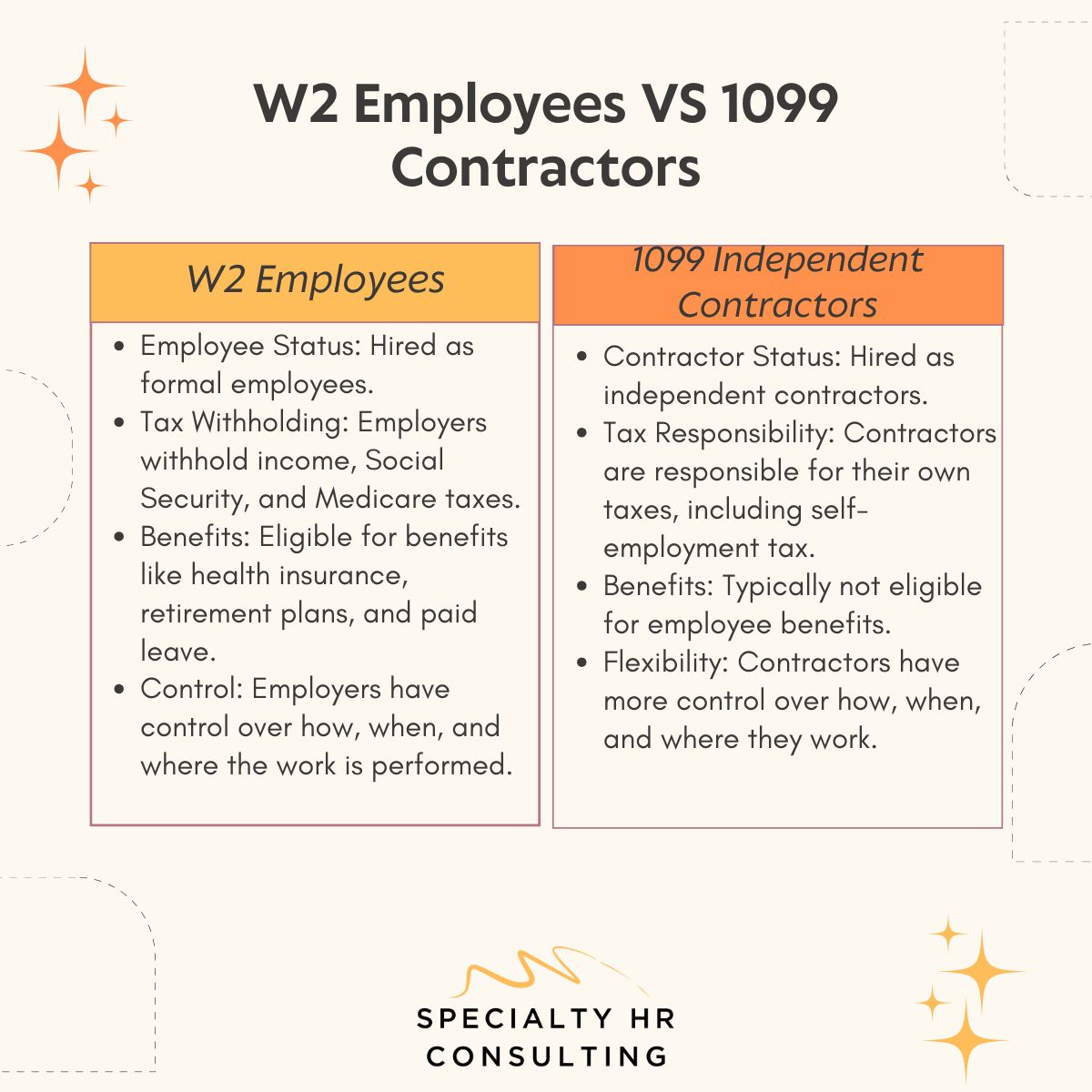

🔺W-2 Employees:

Employee Status: Hired as formal employees.

Tax Withholding: Employers withhold income, Social Security, and Medicare taxes.

Benefits: Eligible for benefits like health insurance, retirement plans, and paid leave.

Control: Employers have control over how, when, and where the work is performed.

🔺1099 - Independent Contractors:

Contractor Status: Hired as independent contractors.

Tax Responsibility: Contractors are responsible for their own taxes, including self-employment tax.

Benefits: Typically not eligible for employee benefits.

Flexibility: Contractors have more control over how, when, and where they work.

🔺Why It Matters:

Compliance: Misclassifying employees can lead to legal issues and fines.

Cost: 1099 contractors can be cost-effective for short-term projects, while W-2 employees are better for long-term roles with a need for consistency.

Management: Understanding these differences helps you manage your workforce more effectively and ensure legal compliance.

Let Specialty HR Consulting help you determine the best mix for your business needs and ensure compliance with all relevant laws and regulations!

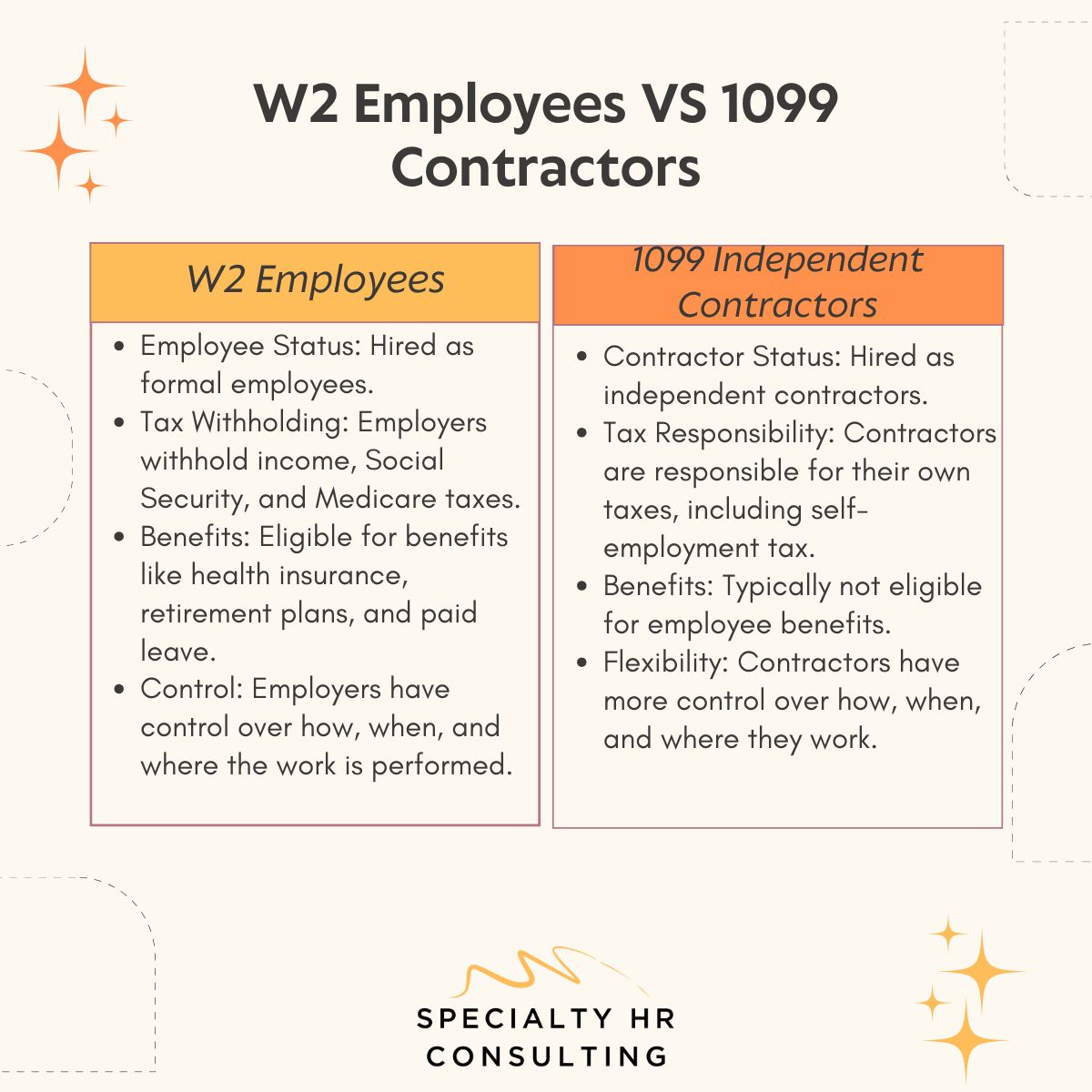

🔺W-2 Employees:

Employee Status: Hired as formal employees.

Tax Withholding: Employers withhold income, Social Security, and Medicare taxes.

Benefits: Eligible for benefits like health insurance, retirement plans, and paid leave.

Control: Employers have control over how, when, and where the work is performed.

🔺1099 - Independent Contractors:

Contractor Status: Hired as independent contractors.

Tax Responsibility: Contractors are responsible for their own taxes, including self-employment tax.

Benefits: Typically not eligible for employee benefits.

Flexibility: Contractors have more control over how, when, and where they work.

🔺Why It Matters:

Compliance: Misclassifying employees can lead to legal issues and fines.

Cost: 1099 contractors can be cost-effective for short-term projects, while W-2 employees are better for long-term roles with a need for consistency.

Management: Understanding these differences helps you manage your workforce more effectively and ensure legal compliance.

Let Specialty HR Consulting help you determine the best mix for your business needs and ensure compliance with all relevant laws and regulations!

Specialty HR Consulting

HR Consultant

At Specialty HR Consulting, we champion a collaborative HR consulting approach. Our method involves working closely with your team to deeply understand your unique challenges, aspirations, and core…

Would you like to promote an article ?

Post articles and opinions on San Jose Professionals

to attract new clients and referrals. Feature in newsletters.

Join for free today and upload your articles for new contacts to read and enquire further.